We create customized, integrated investment solutions to meet the unique needs of insurers and pension plans.

When you select to manage institutional assets, you will discover why we’ve earned the reputation for solid performance and equally solid relationships..

Your financial goals are uniquely your own, so will design a wealth management strategy that’s just for you.

Financial Analysis

provides advanced investment strategies and wealth management solutions to forward-thinking investors around the world. Through its distinct investment brands Management, we offers a diversity of investment approaches, encompassing bottom-up fundamental active management, Responsible Investing, systematic investing and customized implementation of client-specified portfolio exposures. Exemplary service, timely innovation and attractive returns across market cycles have been hallmarks of since the origin..

Financial Planning

A solid Wealth Plan ensures you have a financial strategy that supports your aspirations. Once we understand your lifestyle goals, we look at the current path of your finances to ensure that you are on track to meet them through retirement and beyond.

GLOBAL AGGREGATE

Seeks excess returns through country, maturity, credit, and currency selection. The strategy targets the credit and duration profile of the benchmark and so does not seek to engage in duration timing or sector selection.

EMERGING MARKETS HARD CURRENCY

Seeks excess returns through country, maturity, and currency selection across hard currency and local currency markets. While the strategy includes local currency investments, it takes no beta to local currency debt, engages in no overall duration or spread timing, and targets a beta of one to its hard currency benchmark.

Our Investment Plan

£500 Max £ 4,999

- Duration: 1 Day(s)

- Ref commission: 5%

- Instant Payment

- Profit: 10%

- - - - - -

£5,000 Max £ 49,999

- Duration: 1 Day(s)

- Ref commission: 5%

- Instant Payment

- Profit: 50%

- - - - - -

£50,000 Max Unlimited

- Duration: 7 Day(s)

- Ref commission: 5%

- Instant Payment

- Profit: 700%

- - - - - -

£1,000 Max £ 599

- Duration: 1 Day(s)

- Ref commission: 5%

- Instant Payment

- Profit: 20%

- - - - - -

£15,000 Max £ 50,000

- Duration: 1 Day(s)

- Ref commission: 5%

- Instant Payment

- Profit: 20%

- - - - - -

About Finance

We believe that high-quality companies which manage ESG risks and opportunities well will make attractive long-term investments. Our research team considers ESG factors when evaluating individual companies and when they assess fund managers. Through the use of Sustainalytics, a third-party provider of ESG data, material risks and opportunities are fed into traditional financial analysis and models for our ‘buy list’ stocks.

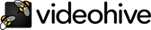

4 Top Invested Projects

Renewable Energy

Real Estate

Modern Agriculture

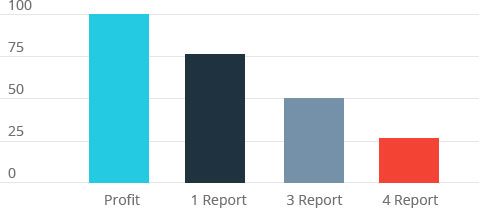

Weekly Financial Report

Creating a weekly financial report involves gathering relevant financial data, performing calculations, and presenting the information in a clear and meaningful way.

Remember that the format and content of your weekly financial report can vary based on the needs of your organization and the audience you're presenting to. Utilize tools like Microsoft Excel, Google Sheets, or specialized accounting software to help with data calculations and visualization. Regularly reviewing and analyzing these reports can provide valuable insights into your business's financial performance and help inform decision-making.

What Our Client’s Say

I've had incredible customer service since i started investing here, I'm a repeat investor. I've been investng with Dormant Assets Exchange for nearly 3 years now and i've loved every bit of the experience so far.

Mike Hussy

Co-FounderI have always been searching for an opportunity to earn on bitcoin and finally I found Dormant Assets Exchange and they have proven to be very reliable since i've been investing with them.

Zenifar Lopez

MarketingTransparent, profitable, and reliable bitcoin investment company that will make you real money. Thanks to all of you at Dormant Assets Exchange for the excellent service.

Robert Smith

AccountantDormant Assets Exchange has been a game-changer for our business. Their comprehensive services and deep industry knowledge have significantly impacted our bottom line.

Mike Hussy

Co-FounderOur Latest News